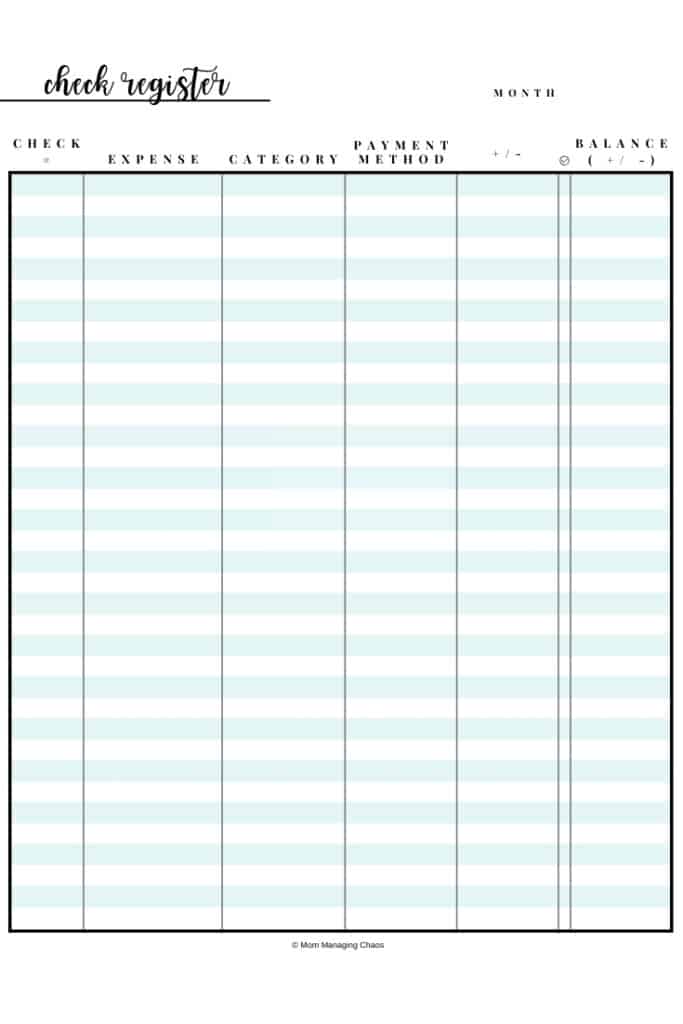

The general ledger also contains the chart of accounts, the main list of account numbers, and the names of each of the accounts, including: A balance: The general ledger will list the account balance whenever a debit or credit is posted to the account.Debit and credit columns: For every entry, you’ll record a debit or credit.A description: Here, you will describe the transaction in less detail than the actual journal entry.A journal entry: This is where you record the journal entry number along with the entry date.The information in a general letter is broken up into the following parts (also known as accounts): With this ledger, a business can prepare its financial statements.

#Balancing a checkbook ledger trial#

This ledger is used to record each transaction and uses a trial balance to validate the information. General ledgerĪlso known as an accounting ledger, the general ledger serves as the record for a business’s financial data. Here are some common types to be aware of and when to use them, beginning with a general ledger of course. Depending on the size of your business and what your business does, you may not need to use all of them.

#Balancing a checkbook ledger software#

Most accounting software will compile some of these ledgers together while still letting you view them independently. There are several kinds of ledgers that you may use in the course of bookkeeping for your business. Some accounting solutions alert users when a journal entry does not balance total debits and credits. If the accounting equation is not in balance, there may be a mistake in your journal entry. The balance sheet formula adds liabilities and owner’s equity to determine a business’s assets. For example, you may have 10 payments listed on the credits side to pay for supplies but only two sales (listed in the debits side).ĭouble-entry bookkeeping keeps the accounting equation (or balance sheet equation) in balance. However, the number of debit and credit accounts does not have to be equal, as long as the trial balance is even. When a company borrows funds, the cash balance increases, and the debt (liability) balance increases by the same amount.

The information in the ledger can help management with decision-making based on financial data. An accounting ledger records transactions and helps generate financial statements for investors, creditors, or even regulators.

0 kommentar(er)

0 kommentar(er)